Episodes

Wednesday Feb 16, 2022

Market Moment (02.16.2022)

Wednesday Feb 16, 2022

Wednesday Feb 16, 2022

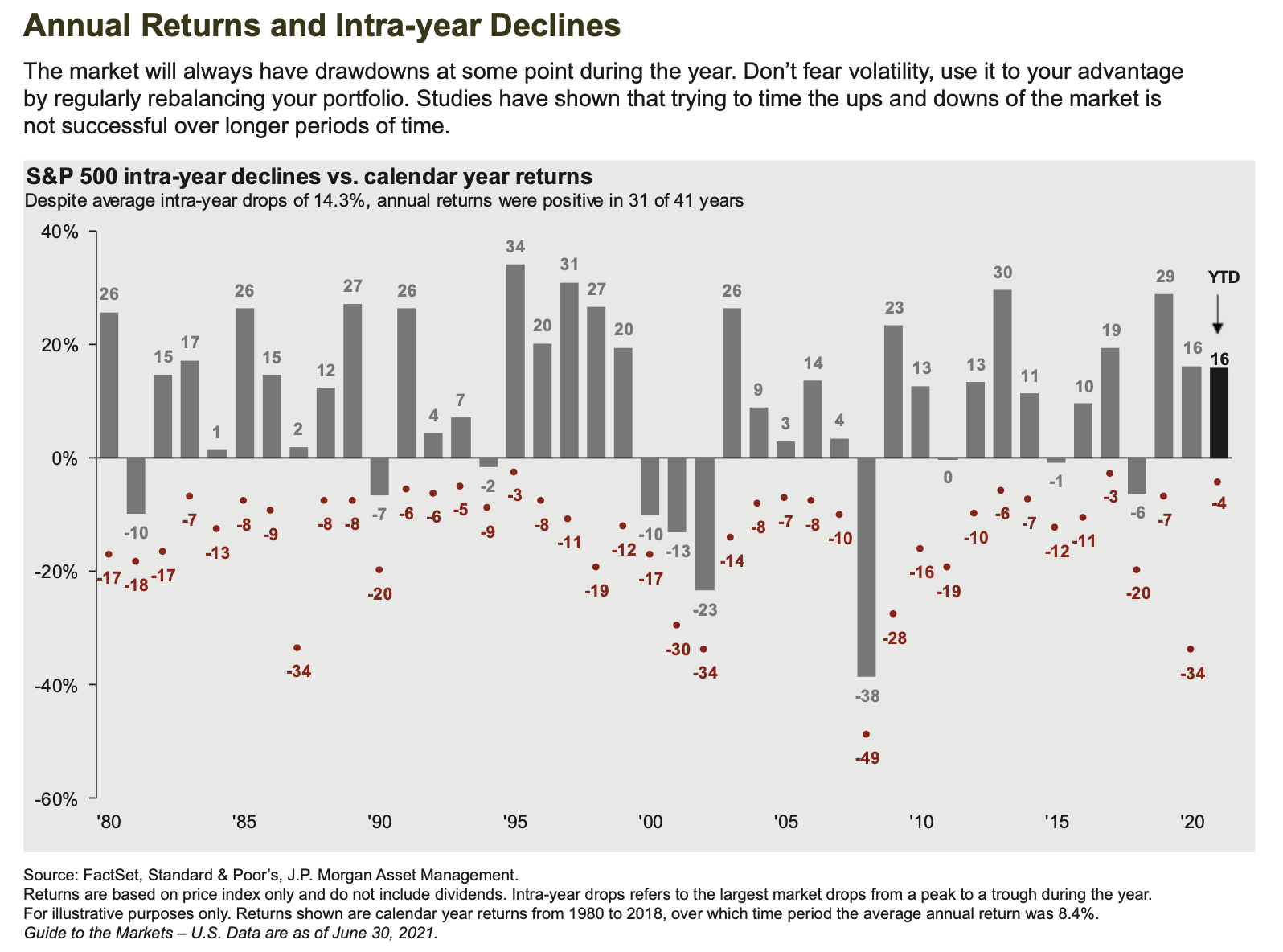

Thoughts on the current market environment. Reasons for the market volatility and stock market pullback. Perspective.

Friday Jan 21, 2022

Defining ”Financial Planning”

Friday Jan 21, 2022

Friday Jan 21, 2022

Discussion with Ian Freemire, CFP on the subject of Financial Planning and how it's viewed and defined.

Thursday Jan 20, 2022

Market Timing: Part Two

Thursday Jan 20, 2022

Thursday Jan 20, 2022

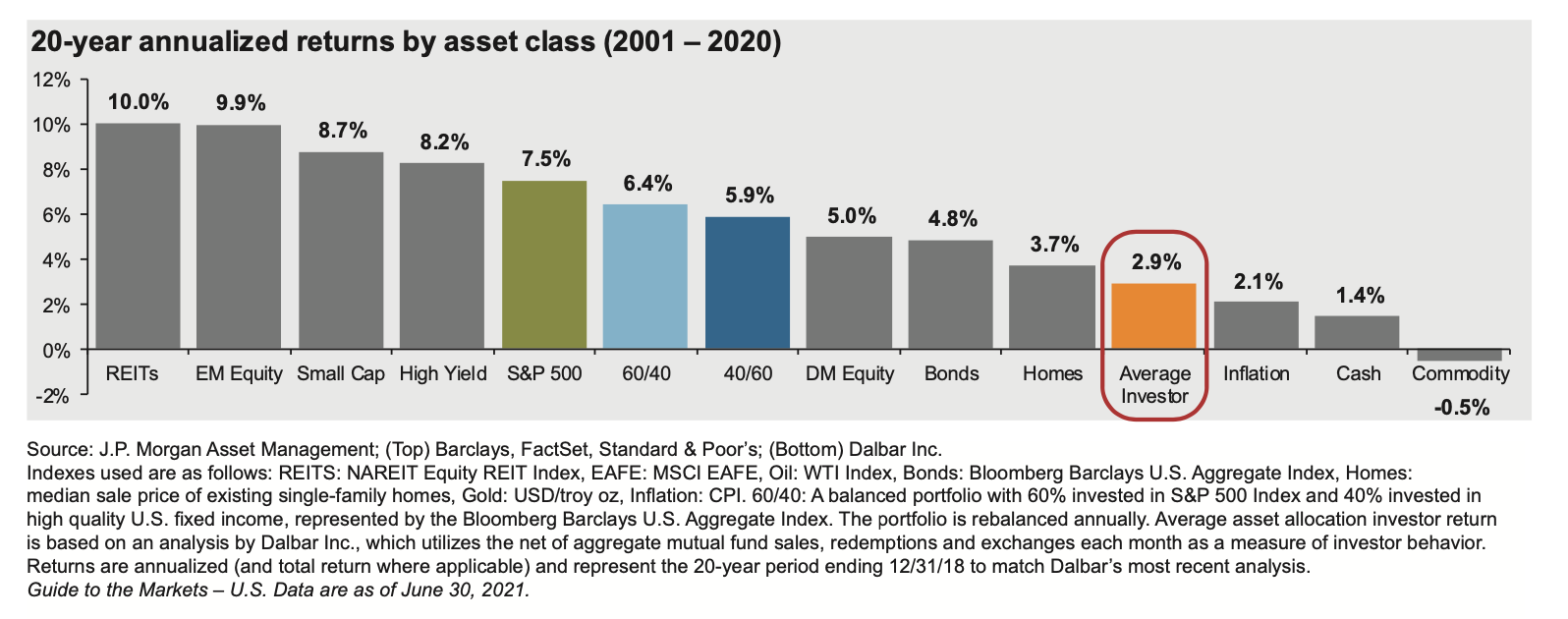

In part two of our Market Timing episode we will discuss how to invest, and stay invested by discussing our Four Keys To Successful Investing.

Thursday Jan 20, 2022

Market Timing: Part One

Thursday Jan 20, 2022

Thursday Jan 20, 2022

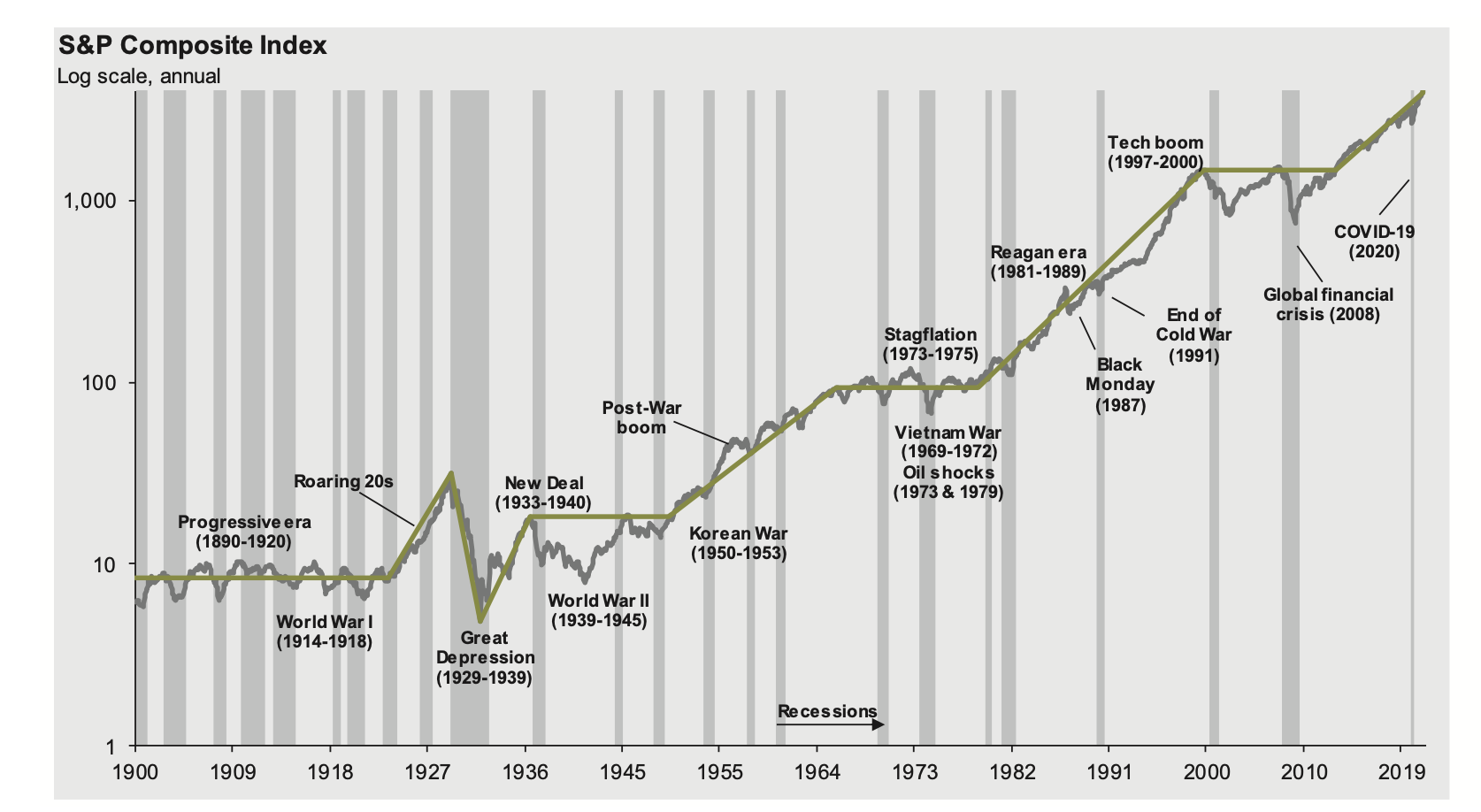

In part one of our Market Timing episode, we will discuss the difficulty in trying to guess the ups and downs of the stock market.

Thursday Jan 20, 2022

Don’t Be Afraid of Bonds

Thursday Jan 20, 2022

Thursday Jan 20, 2022

There are reasons to have an allocation to fixed-income in your portfolio. There are ways to protect yourself against rising rates and inflation.

Thursday Dec 09, 2021

Introduction to Money Uncomplicated

Thursday Dec 09, 2021

Thursday Dec 09, 2021

Be sure to click "follow" in the upper right hand corner. Download the Podbean App on your iPhone or Android device. Bookmark this page on your computer.

Money Uncomplicated

Podcast created by Windsor Capital Management, LLC. WCM is a fee-only registered investment advisory firm specializing in equity, fixed income and balanced portfolio management. As a fee-only advisor, our compensation is derived solely from our annual advisory fee, based on assets under management. We do not receive commissions or any type of compensation for the buying or selling of any security or product. We manage portfolios for families, high net-worth individuals and institutional clients. Serving clients in over thirty states, we are dedicated to unbiased advice and goal-oriented investment management.

It's not about timing the market, but time in the market that counts.

Rebalancing a tactically-weighted portfolio is the successful alternative to emotional decision making.